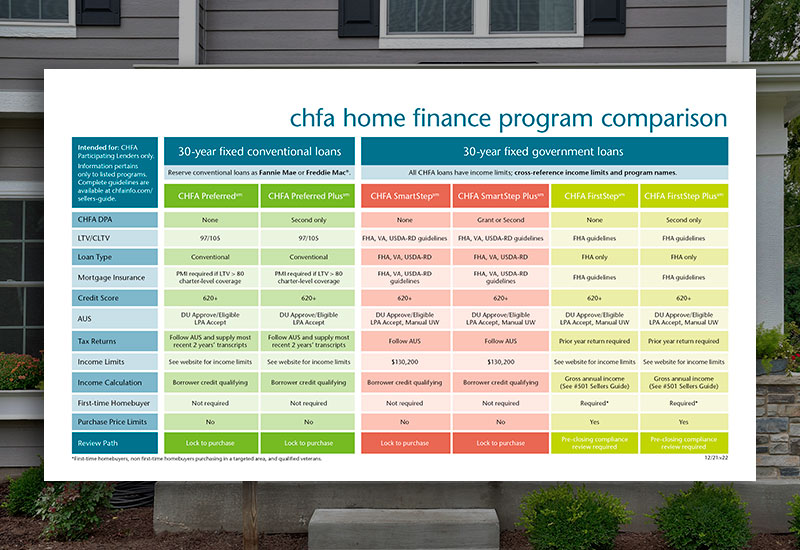

Program Comparison Card

View side-by-side program comparisons and learn CHFA program tips.

Select a program name from the dropdown menu below to find corresponding highlights, matrices, income limits, and forms. Forms are also available in CHFA HomeConnectionsm on an individual loan basis.